Budget Busters Answer Key Bella takes center stage, offering a captivating guide to financial freedom. Join Bella as she shares her expert insights, strategies, and tools to help you conquer budget busters and achieve financial success.

Bella’s practical approach and engaging storytelling make this a must-read for anyone looking to improve their budget management skills and live a more financially secure life.

Bella’s Budget Busters

Bella’s Budget Busters is a concept that highlights the common pitfalls and challenges individuals face when managing their finances. It focuses on identifying the hidden expenses and impulsive purchases that can derail even the most well-intentioned budget.

Budgeting is essential for financial stability, but it can be a complex and daunting task. Bella’s Budget Busters aims to simplify the process by providing practical tips and strategies for overcoming these obstacles.

Typical Budget Busters

Some common budget busters include:

- Unnecessary subscriptions and memberships

- Impulse purchases

- Dining out too often

- Unplanned expenses (e.g., car repairs, medical bills)

- Fees and penalties (e.g., late payment fees, overdraft charges)

Bella’s Strategies for Overcoming Budget Busters

Bella’s approach to managing budget busters is a combination of meticulous planning, proactive measures, and disciplined spending habits. She understands that budgeting is an ongoing process that requires regular monitoring and adjustments to stay on track.

Budget busters answer key bella is a valuable resource for anyone looking to manage their finances effectively. It provides practical tips and strategies for cutting expenses and saving money. However, if you find yourself struggling to wake up on time, an alarm clock that squirts water might be just what you need.

These innovative devices are designed to wake you up by spraying a gentle stream of water on your face. While this may sound unpleasant, it’s surprisingly effective in getting you out of bed. Budget busters answer key bella also offers advice on how to use these alarm clocks effectively, ensuring you get a good night’s sleep and wake up refreshed and ready to start your day.

To identify budget busters, Bella tracks her expenses diligently. She uses a budgeting app to categorize her spending and pinpoint areas where she may be overspending. By analyzing her spending patterns, she can identify recurring expenses that are not essential and can be reduced or eliminated.

Setting Financial Goals and Creating a Realistic Budget

Bella believes that setting financial goals is crucial for successful budgeting. She sets specific, measurable, achievable, relevant, and time-bound (SMART) goals to provide direction and motivation for her financial decisions.

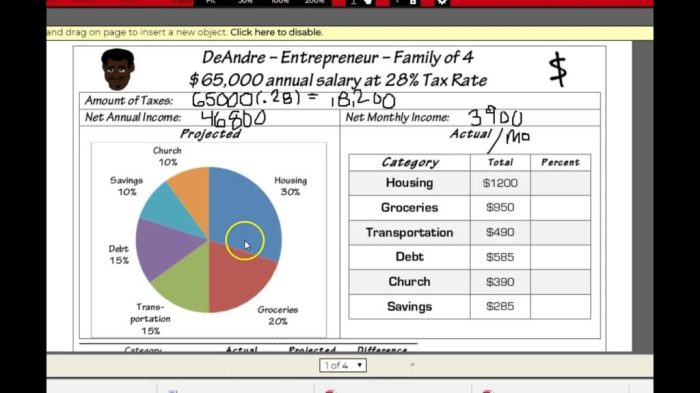

To create a realistic budget, Bella uses the 50/30/20 rule. This rule allocates 50% of her income to essential expenses (e.g., housing, food, transportation), 30% to discretionary expenses (e.g., entertainment, dining out), and 20% to savings and debt repayment.

Specific Tips and Strategies

- Negotiate bills:Bella regularly reviews her bills and negotiates with service providers to lower her monthly expenses.

- Shop around for insurance:She compares insurance quotes from multiple providers to find the best coverage at the most affordable price.

- Cook meals at home:Bella prepares meals at home instead of dining out frequently, saving significant money on food expenses.

- Take advantage of discounts:She uses coupons, promo codes, and loyalty programs to reduce the cost of purchases.

- Avoid impulse purchases:Bella waits 24 hours before making non-essential purchases to avoid unnecessary spending.

- Create a sinking fund:She sets aside money in a separate account for irregular expenses (e.g., car repairs, medical bills) to prevent budget disruptions.

Bella’s Budget Management Tools

Bella relies on a combination of technology and traditional methods to manage her budget effectively. She utilizes various tools and resources to track her expenses, stay organized, and make informed financial decisions.

Budgeting Apps

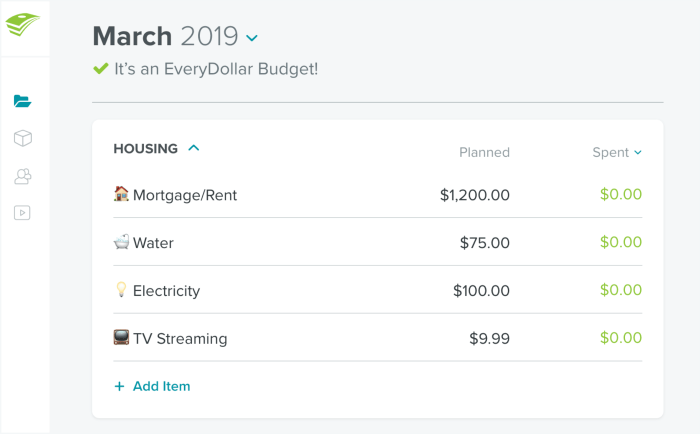

Bella finds budgeting apps particularly useful for their convenience and accessibility. She uses the “Mint” app, which allows her to connect all her financial accounts in one place. This provides her with a comprehensive view of her income, expenses, and spending patterns.

Other popular budgeting apps include “YNAB” (You Need a Budget) and “EveryDollar”. These apps offer features such as expense tracking, budgeting, and financial goal setting, making it easier for users to manage their finances.

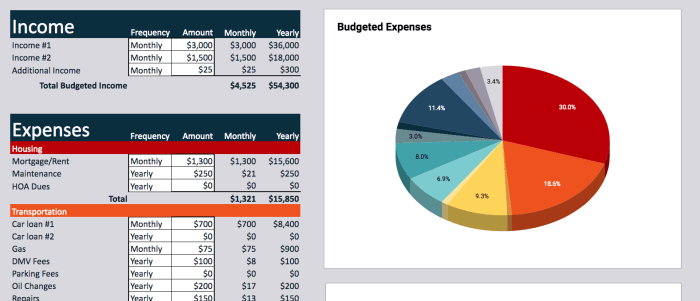

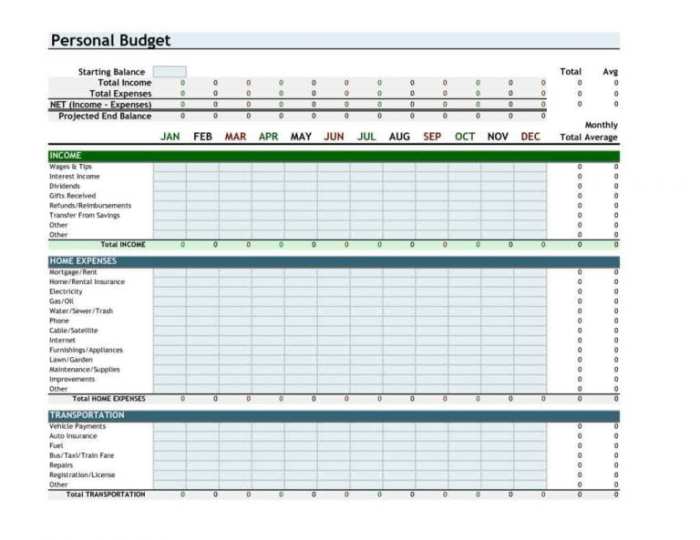

Spreadsheets

Bella also uses spreadsheets as a budgeting tool. She creates custom templates to track her income, expenses, and savings. Spreadsheets provide her with flexibility and control over her budget, allowing her to categorize expenses, set financial goals, and monitor her progress.

Physical Envelopes

For certain categories of expenses, such as groceries or entertainment, Bella uses the “envelope method”. She allocates a specific amount of cash to each category and keeps it in separate envelopes. This helps her stay within her budget and avoid overspending.

Benefits of Technology for Budget Management

Technology offers numerous benefits for budget management. Budgeting apps and spreadsheets provide real-time tracking of expenses, allowing Bella to identify areas where she can save money. These tools also generate reports and charts that help her visualize her spending patterns and make informed decisions.

Furthermore, technology makes it easier to set financial goals and stay motivated. Budgeting apps often include features such as reminders, alerts, and progress tracking, which help Bella stay on track and achieve her financial objectives.

Bella’s Mindset and Habits for Financial Success

Bella’s mindset towards money management is characterized by discipline, self-control, and delayed gratification. She understands that financial success is not about earning a high income but about making wise decisions with the money she has.

Bella believes that budgeting is essential for controlling expenses and achieving financial goals. She sets realistic budgets and sticks to them, avoiding unnecessary purchases and impulsive spending.

Developing Healthy Financial Habits

To develop healthy financial habits, Bella recommends:

- Creating a budget and tracking expenses

- Setting financial goals and prioritizing saving

- Avoiding impulse purchases and unnecessary debt

- Educating oneself about personal finance and investing

- Seeking professional advice when needed

Breaking Bad Spending Patterns

To break bad spending patterns, Bella suggests:

- Identifying triggers that lead to overspending

- Developing coping mechanisms to deal with emotional spending

- Rewarding oneself for sticking to financial goals

- Seeking support from friends, family, or a financial counselor

- Using cash or debit cards instead of credit cards

Bella’s Advice for Others: Budget Busters Answer Key Bella

Bella’s journey has taught her invaluable lessons about budget management. She is eager to share her insights and recommendations with others looking to improve their financial well-being.

Bella emphasizes the importance of setting realistic financial goals. Avoid overwhelming yourself with ambitious targets; start small and gradually increase your savings and debt reduction goals as you gain momentum.

Practical Tips from Bella, Budget busters answer key bella

- Track your expenses diligently to identify areas where you can cut back.

- Negotiate lower interest rates on your debts to save money on interest payments.

- Consider consolidating your debts into a single loan with a lower interest rate.

- Explore additional income streams to supplement your regular income.

- Seek professional help from a financial advisor or credit counselor if you are struggling to manage your finances.

Seeking Professional Help

Bella acknowledges that budget management can be challenging, and there is no shame in seeking professional help if needed. Financial advisors and credit counselors can provide personalized guidance, support, and accountability to help you achieve your financial goals.

Popular Questions

What are some common budget busters?

Common budget busters include impulse purchases, dining out, entertainment expenses, and unnecessary subscriptions.

How can I identify and address budget busters?

To identify and address budget busters, track your expenses, categorize them, and identify areas where you can reduce spending.

What tools can I use to manage my budget effectively?

Effective budget management tools include budgeting apps, spreadsheets, and online budgeting platforms.